Table of Content

A survey from Fannie Mae showed that only 16% of people think this is a good time to buy a home, a record low. The central bank said it anticipates multiple similar hikes throughout 2022 and 2023 until inflation gets under control. However, opportunities to lock in a lower interest rate do still exist for home buyers and refinancing homeowners. Rate quotes can also vary massively based on the details of your specific scenario. As such, the best use of any timely, accurate rate index is to observe the day-to-day change. A discount point can lower interest rates by about 0.25% in exchange for upfront cash.

Both interest rates and house prices impact home buyers, particularly first-time home buyers. If the interest rates or housing prices are especially high, first-time buyers may be hesitant to enter the market. COVID-19 caused interest rates to drop to historic lows, so people may be nervous at the news that mortgage rates are rising. However, when you consider interest rates from a historical perspective, you can see that rates are still low in comparison. Housing demand was also very weak as the homeownership rate fell for more than a decade, from 2004 through 2016.

Healthcare Business Loans

Many experts believe things could get worse because inflation has embedded itself so completely into the economy’s psyche. Based on the purchase/refinance of a primary residence with no cash out at closing. Some jumbo products may not be available to first time home buyers. The rate for a 15-year mortgage, popular with those refinancing their homes, edged down to 5.76% from 5.9% last week. Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate fell to 6.49% from 6.58% last week. When you get pre-approved, you’ll receive a document called a Loan Estimate that lists all these numbers clearly for comparison.

In particular, home prices and interest rates impact the following two factors. There are some parallels between mortgage rates in the 1970s and today—a combination of high inflation and large government spending due to the Covid-19 pandemic. A low interest rate home loan can be the best option to apply for. Which can be a flat amount or a percentage of the transferred balance. Some lenders can also give you a waiver on the balance transfer fee. However, such offers don’t last forever as they are valid for a specific period.

Update example to average loan amounts and rates as of May 5, 2022

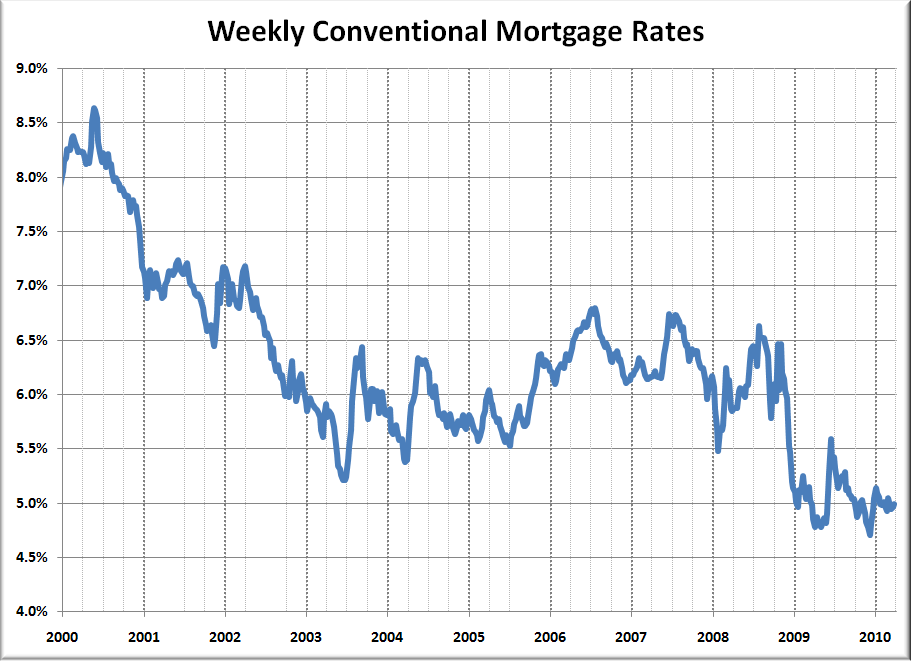

However, the difference increases when 30-year rates begin to rise significantly. In March 2022, the Consumer Price Index, an important gauge of consumer inflation, increased by 8.5% — the largest 12-month spike since 1981. Rates were already headed higher before the inflation report, starting the year off at 3.45% in January. They’ve steadily risen each month in 2022, with the U.S. weekly average 30-year fixed rate rising to 5.30% as of May 12, 2022. The downward trend in mortgage rates stalled out and reversed course with rates jumping back above 8% in 2000. However, they gradually made their way back below the 6% mark by 2003 and remained in the high 5% to low 6% range for the rest of the decade, before briefly dropping to a decade low of 4.81% in 2009.

The Federal Reserve – the U.S. central bank – is raising rates in response to rising inflation. Actual payments will vary based on your individual situation and current rates. The average long-term US mortgage rate ticked down for the third week in a row and have fallen more than a half-point since hitting a 20-year high less than a month ago. The pace slowed in the second quarter, then interest rates shot up again after the Feds 0.75% federal funds rate hikes in June, July, September, and November. Remember that your mortgage rate is not the only number that affects your mortgage payment.

Mortgage Rate Trends

Read our article to learn what bond loan interest rates are and how they affect mortgage rates. Your credit score, down payment, loan type, loan term, and loan amount will affect your mortgage or refinance rate. Much of your mortgage rate will depend on personal factors such as where you live,your credit scoreandhow much you expect to put as a down payment, plus the mortgage type, term and amount. That said, some mortgage lenders are known for helping homebuyers get as low a rate as possible. The lowest 15-year fixed mortgage rates in history occurred during May 2013.

ÂThe best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own. The current housing environment is particularly tough for first-time homebuyers, but it might still make sense to buy. Its always a good time to buy a home, if thats what is important to you. Its just about doing your research and making good informed decisions, Eileen Derks, head of mortgage at Laurel Road, told us. For instance, if the index is at 4.07, the predominant top tier rates would be 4.00% and 4.125%. Still, lenders may offer more than just 30- and 15-year terms — you could find 10- to 40-year terms with some lenders.

Savings Account Rate Trends

Personal loan rates have fluctuated since the early 1970s, but have ultimately decreased over the last four decades. For 24-month personal loans issued by commercial banks, rates are 10.05 percent as of February 2017, according to the Board of Governors of the Federal Reserve System. This is down from 12.38 a decade earlier in 2007, and more than 6 percent lower than the peak rate of 18.65 percent in 1982.

Let’s look at a few examples to show how rates often buck conventional wisdom and move in unexpected ways. Former Chairman of the Federal Reserve Alan Greenspan and former Chairman of the U.S. Securities and Exchange Commission Chris Cox have made mistakes that cost billions.

The Depression kept interest rates low in the 1930s and during the war years of the 1940s, interest rates were pegged. It was only after the Treasury-Federal Reserve Accord of 1951 that the federal funds market emerged as the main market for U.S. banks to lend and borrow money from each other. Borrowers may be able to find a lower interest rate by shopping around rather than accepting the first loan offered. It is possible to reveal to each lender that another is offering a better rate as a negotiation tactic.

Fixed rate loans come with the same rate of interest throughout the tenure. Whereas floating rate loans will see changes in the interest rate as and when changes take place in the market. Even with rate changes, floating rate home loans have lesser interest obligations for borrowers than what could be the case with fixed rate loans. You can get it converted into a floating rate and save on the interest. Check out the table below to know the conversion fee applicable to changing from a fixed rate to a floating rate.

If the Fed can slow housing cost growth, it’s likely there will be a multiplying effect on the rest of the economy. However, experts say the Fed is wary of caving to market expectations too soon and having inflation rears its head again. Forty-seven of the 51 counties tracked by C.A.R. experienced an increase in active listings from last October, a slight dip from 48 counties recorded in September.

No comments:

Post a Comment